Review and Outlook

The third quarter ushered in a tremendous amount of volatility as global financial markets reacted as perceptions for whether a trade deal with China was crumbling or not. So far, as we are writing this piece, it has been much ado over nothing as the S&P 500 ended in the black, up +1.9% for the quarter. Returns year to date through the third quarter range from around 10% for International stocks, 13% for small and midcap US stocks, 15% for the Dow Jones Industrials and a little over 18% for the S&P 500. Our outlook since midyear has been for a choppy range in the second half of the year and we believe this is still the most likely outcome.

More importantly, the ingredients for a secular bear market still don’t seem to be at hand: the economy continues to bump along at around 2% growth in GDP – certainly not strong, but not weak enough to generate a recession. The Fed is in an easing mode which the market has generally taken solace from. Technical trends are positive, and sentiment isn’t too overbought.

However, there are longer term concerns: the economic expansion is aging; the yield curve is flat/inverted signaling potential meaningful future economic weakness; Europe appears to be entering a recession; and valuations can only be characterized as somewhat expensive and certainly not cheap, while corporate earnings seem to be slowing. While we do not believe a recession is imminent, it’s clear we must keep our eye on the ball for a potential future bear market.

The Economy, Monetary and Fiscal Policy, and Earnings

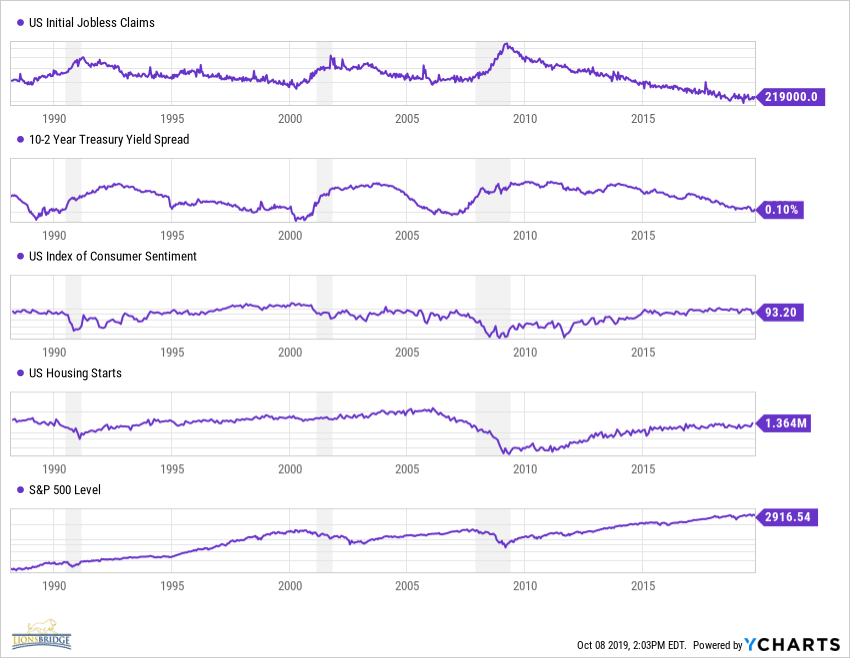

The fundamentals we monitor do not currently argue for a recession: Exhibit A (Last Page) shows a number, but not all, of the most important factors we monitor. Recessions are usually accompanied by rising Jobless Claims, a flat or inverted Yield Curve, waning Consumer Sentiment and falling Housing Starts. Presently, only the Yield Curve is flashing a warning.

The Institute for Supply Management’s (ISM) Manufacturing Purchasing Managers’ Index (PMI) fell to 47.6 in September, the lowest level since June 2009. This was weaker than expected and is another sign that trade tensions have stalled demand. The Non-Manufacturing PMI was also weaker than expected, registering a 52.6 level. Measures below 50 are considered recessionary warnings. Manufacturing makes up only about 12% of overall U.S. gross domestic product (GDP), while the Non-Manufacturing component is 88% of the economy and it appears to still be improving, albeit somewhat slower than presumed. If the consumer stays healthy, we think this recent manufacturing slowdown won’t lead to a recession, but we are clearly at levels that argue for a heightened level of concern.

Another negative we are monitoring is earnings growth, which has weakened. FactSet estimates that the earnings decline for Q3 2019 will be -4.1%, marking this as the 3rd straight quarter of YoY earnings declines since the earnings recession of 2015-2016. This doesn’t immediately doom the market, as the earnings slow down back then didn’t usher in a recession or bear market. But there was a lot of volatility then, so again, we need to watch the coming earnings season carefully!

We would be remiss if we didn’t address the current impeachment proceedings and upcoming election next year. Stocks performed impressively after President Clinton’s impeachment proceeding began, which, incidentally, was during the late 1990s tech boom. On the flip side, stocks suffered a severe bear market and recession when impeachment proceedings were initiated against President Nixon. The takeaway is that underlying economic issues are usually more important than the impeachment itself. Moreover, we doubt the Republican Senate would let an impeachment go through. If economic fundamentals hold, we doubt the impeachment will have a lasting effect on the market. In fact, over the last 11 election cycles, if the economy was not in recession within two years of a re-election, the sitting president won. The seven times there was a recession, the incumbent president did not get re-elected five out of the seven times. As James Carville said, “it’s the economy, stupid” and that is what we will be monitoring!

From a market perspective, the rise of Elizabeth Warren, and some extreme democratic economic ideas, could cause a severe market reaction. The combination of a Warren White House and a Democratic Congress would be extremely challenging for stocks from a bottom-up perspective, given the ambitious scope of the senator’s policy prescriptions on everything from banking regulation, wealth taxes and Medicare for All. Even if Democrats take back the White House, regaining the Senate will be more difficult, and a Republican Senate could block many of the more extreme proposals put forward by Senator Warren. The stock market has historically performed well when Democrats control one-part of Congress. The market has performed best when a Democrat is in the White House, but control of Congress is split.

Sentiment and Technicals

While the volatility in August raised our level of concern, the long-term damage was limited, and our longer-term models remained positive. There has been some deterioration in the markets this month, but it has yet to impact our longer-term model. However, our short term and intermediate term models are getting cautious and we believe there will be more volatility.

To illustrate, 2019 is the first year since 1997 where the S&P 500 rallied more than 20% on a total return basis in the first nine months of the year. In prior years, when the first nine months of the year were so strong, October tended to see below-average returns but performance for all Q4 was better than average.

While we have had a strong rally YTD, the market is pretty much where it was the last 1, 2, 6, 12, and 20 months ago. This has happened 12 other times and over the next year, 25% of the time the market is flattish again. But, 25% of the time, the market is down more than -20%, and 50% of the time, the market is up more than +10%.

The above analysis cements our view that we should have a lot more volatility going forward, and how it plays out could be more bearish or even more bullish than most expect!

Equity and Fixed Income Strategy

Our equity strategy has continued to exceed its Policy Benchmark – our stocks are doing well this year, and the ETF strategy is doing better than the US Small/Mid Cap and International indices. Our Alternative Strategy is keeping pace with its benchmark this year, but over the last 12 months is doing much better, as the defensive posture we took in 4Q 2018 was correct.

The same themes are intact from last quarter – we are looking to add to our stock holdings, but we are looking for more volatility before we commit. While we wait, we are investing in index ETF strategies that we favor. We still feel that in a weak economic environment, US Small/Mid Cap and International should underperform, but there is likely a time frame in the future where these areas will be rewarding, we just can’t pinpoint it yet.

Interest rates are being pushed down due to international economic weakness – more than they should be given the US fundamental outlook- so a cautious approach here is still prudent. Accordingly, our average maturity is about the same as our benchmarks and our credit quality is higher.

Leave A Comment