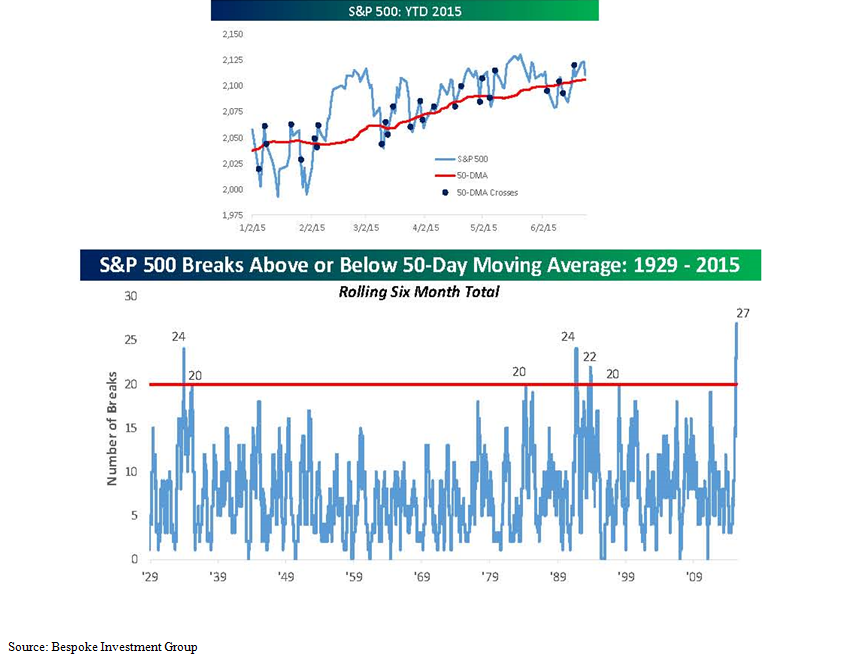

Since the start of the year, the market has been trading in a very narrow range, with multiple crosses over the 50 day moving average, a measure that many market participants use to gauge the intermediate direction of the market. There have been 27 crosses above or below the 50 day moving average since January with the market contained in less than a 5% range. This number of crosses has never occurred in such a short period of time (six months) going back all the way to 1929!

Extreme range bound volatility is not a good environment for our Long/Short hedging strategy. By its nature, this strategy needs a trend; either up or down. A whippy directionless market makes for a difficult environment. Fortunately, history has shown that this won’t last forever and we will eventually break out of this range either to the upside or downside. While it has been a frustrating time for this strategy, it seems a reasonable bet that the worst of its underperformance is behind it.

Our friends at Bespoke illustrate the historic choppy market we are experiencing in the two charts below.