Overview

The U.S. equity market has rallied further this year than we expected, and more than most professional procrastinators predicted. We started the year with significant fundamental headwinds, which the equity market has ignored – an inverted yield curve, a banking crisis resulting in tighter lending standards, slowing earnings and a continuation of the Ukrainian conflict. While equity investor sentiment has been overwhelmingly negative, what has become clear is that the equity market is attempting to price in the possibility of a rare, soft economic landing. Earnings and the economy have softened, but we are not yet at recessionary levels. The longer this remains the case, the more it seems the chance for a soft landing improves.

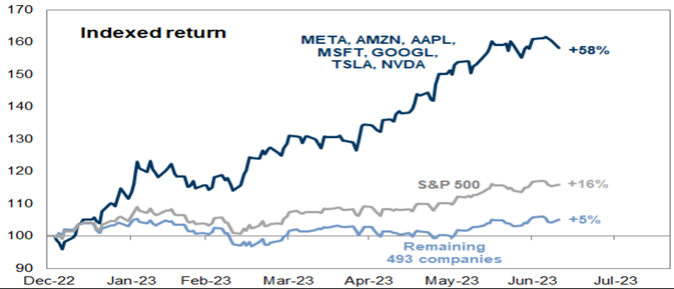

When we casually say, “the market,” the underlying performance is very bifurcated this year. The S&P 500 is up 16% through the first half of the year, but the Dow Jones Index, the equal-weight S&P 500 and the Russell 1000 equal weight index are only up around 5-6%. More on that later in our Outlook.

The Economy, Federal Reserve Monetary Policy, and Interest Rates

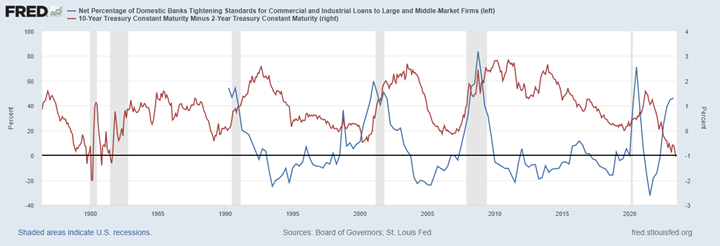

The economy has been close to official recessionary levels, but there are enough positive signs from the service side of the economy to keep the overall economy in decent shape. Ordinarily, higher rates, which translate into higher borrowing costs for consumers and companies, should help cool the economy. Employment has been a major surprise this year. Initial Claims for Unemployment (one of our favorite indicators to watch for in a weak economy) have been low. Why have markets kept rising, despite a banking crisis, the threat of a U.S. debt default and more interest-rate increases from the Federal Reserve? The straightforward answer: Time and time again, investors’ worst-case scenarios did not materialize. This has been a major surprise to most analysts, given how inverted the yield curve is and how strained the banking sector is. In the chart below one can see that over 40% of banks are tightening credit and the yield curve is deeply inverted. This is usually a sign of coming economic weakness, but only time will tell.

We believe one of the factors that is stabilizing the economy is fiscal stimulus. Everyone has been looking for a recession and it has not materialized. An overlooked factor is that fiscal stimulus is still pumping through our economy through the CARES Act, Employee Retention Tax Credit, Student Loan deferral, etc. However, many of these programs are ending in the coming months. This has kept the recession that many economists expected out of sight, giving investors hope that equity markets might be able to keep climbing.

Additionally, the stimulus checks and other pandemic support in 2020 boosted savings; and while hard to measure, it looks as if these added savings have just now started to get back down to pre-covid levels. There is a compelling case to be made that the effect from stimulus is pushing out the recession further than anyone imagined in an environment where the Fed has raised rates from 0% to over 5%. However, the effects from monetary tightening occur with long and variable lags.

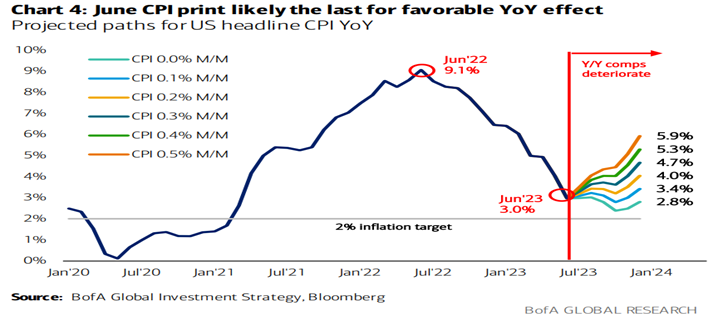

The Fed has been battling inflation for over a year now, and it seems as if they are winning the war as inflation has come down from 9.1% a year ago to 3.1%. This has analysts calling for the next Fed tightening to be their last, which may be the case. This in turn, has spurred the market to look for a Fed Pivot or at least a quiet Fed, with a pivot down the road. While there are good reasons to think that the inflation battle is not yet over, the chart below details the notion that the best of the inflation decline might be behind us. We are not looking for a resumption of inflation, but we do expect that inflation remains sticky around current levels, which means that the fight to lower inflation might take longer than most think and the Fed could very well be in a “higher for longer” mode rather than cutting anytime soon.

Equities: Earnings, Valuation, and Sentiment

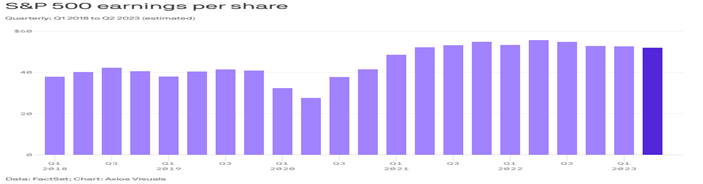

The odd thing about the rally this year is that it is not contingent on an improvement in earnings. Below you can see that earnings have been flat since Q4 2021:

This means that the rally this year has been completely based on an expansion in valuations – the P/E ratio has risen from less than 16X to close to 20X, a rare occurrence without a corresponding decline in interest rates. The market is pricing in a Fed Pivot and soft landing, both of which are quite unassured.

In 2023, we have an equity market rally that has occurred with little, if any, earnings growth while interest rates have gone up. Additionally, rate increases have not ended the economic expansion. Recent data showed gross domestic product the Fed’s increased at a 2% annualized pace significantly faster than the earlier estimate of 1.3% We think this rally is more based on sentiment than anything else. At the end of last year, investors were incredibly negative. There are many ways to measure sentiment, and there is no one good measure. Our favorite measure of sentiment is below, and it highlights that investor sentiment was very oversold.

A year ago, the economic consensus was that we were in an inflationary environment with an aggressive Fed. This narrative has changed over time. Strangely, there still is more equity market pessimism than we would like to see, to help confirm that the market rally has run its course. What we have seen this year is what is commonly referred to as the market “climbing a wall of worry.” Elevated pessimism, and fiscal stimulus, have supercharged what should have been a smaller rally, given where valuations are – not cheap. We use the supercharged word in the literal sense because what is occurring this year is a dramatic rally, until very recently, solely in the tech sector. The top 7 Mega cap tech stocks are up 38% to189% this year. These same stocks were down -30% to -80% last year, leaving most of them lower than they were at the recent market peak in 2022. What has happened is the biggest losers last year experienced some mean reversion and became the biggest winners this year. Putting both years together, not much changed except for a lot of volatility.

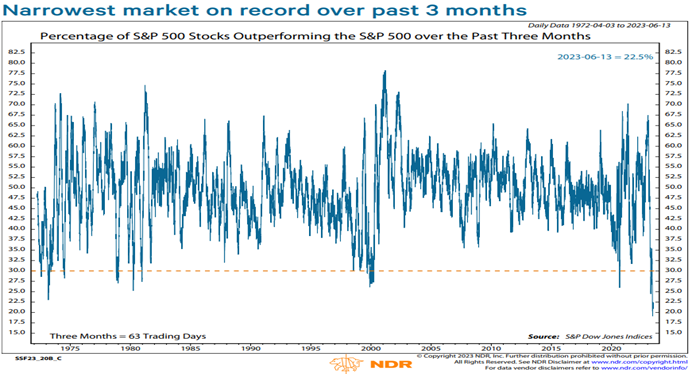

What this has masked is that while the S&P 500 has an impressive 16% gain this year, it is a function of the top 7 companies getting back most of what they lost last year. In the chart on the next page, you can see that the other 493 companies in the S&P are up around 5% – a mild rally. Year to date, 2023 has been a tale of 2 markets: explosive gains in tech but average turns for the rest of the market. Investors are now wondering what this means for future returns.

The year 2023 has been the narrowest rally in the market over the last 50 years. Looking at the chart below, this is exactly what occurred at the top of the market in 1974 and 2000. In 1974, it was the Nifty Fifty market where so-called “one decision stocks” were all the rage. Coke, Proctor & Gamble, and IBM were stocks that were thought to never go down because of their earnings growth and should never be sold. In 2000 it was the .COM bubble where adding .com to your company name was received with explosive price rallies and stocks like Sun Microsystems, Cisco, and Amazon all traded at Price/Sales ratios of 30X – 40X – absurd valuations for Mega cap companies. It is important to note that in both instances, companies like Coke, P&G, Cisco, and Amazon all went on to continue to be very profitable and dominating companies. But their stock prices all went down 50% to 90% in the subsequent bear markets that came because valuations were too rich, and optimism was far too high.

Summary

There are numerous reasons to be fundamentally concerned about the market, but we cannot rule out the possibility of a soft landing. In such an environment, we would not be surprised by the market going higher than most investors expect.

We continue to invest in more market-oriented ETFs as opposed to selecting names. The thought process here is that it is possible we are just in a bear market rally, albeit a powerful one. We still have concerns with equity valuations, earnings, and inflation, and whether the US economy can remain resilient. We prefer the lower volatility and diversification of ETFs over individual names. If we were more assured of a recovery, or valuations were more compelling, we would entertain the higher risk/return tradeoff of adding individual names to the portfolio.

In the near term, the market could move higher, but the risk of more rate hikes makes the path forward uncertain. The US economy continues to hold up, in the face of the unprecedented number of rate hikes by the Fed. Our primary concern is that the lag effects of these hikes may not materialize in the economy until late Q4 or early next year. Simply put, while we are concerned about the longer-term fundamentals and the possibility of a recession, it seems likely to us that this scenario is being pushed out for several months as the market is trying to price in a soft landing.

Our goal is to be appropriately positioned should the rally continue, but we will be ready to reposition conservatively if obvious signs of a downtrend evolve.

Leave A Comment