We want to remind clients why we outline our thoughts on the markets every quarter, and more often when volatility picks up. We believe that following the trends in the market is far more effective than predicting an often-uncertain future. We seldom attempt to “call a high” in the market, as this is usually a fool’s game that causes more harm than good in portfolios. Accordingly, if the market is in an uptrend you will generally find us bullish, and this has mostly been the case since 2012. However, when the markets turn down and we find that the emerging downtrend is supported by negative readings in the Fundamentals, Monetary Policy and Sentiment, this is generally a powerful signal for us to increase our exposure to Fixed Income relative to your Investment Policy and also raise the exposure to Alternative Strategies that offer protection in a bear market. It is through this communication that we let you know what we are seeing and the metrics we are evaluating to determine if we need to become more conservative in our approach in managing your money.

We also use this piece to offer insights as to what is happening “inside” the various sectors and subsectors we have invested in to produce the best possible returns for you.

Review and Outlook

After a volatile Q3, the market had a strong move up to new highs in the 4th quarter on the back of optimism over a trade deal, a US economy still moving in the right direction (albeit somewhat slower than we would like), and a Federal Reserve that last eased a few months ago, and seems to be far from another wave of rate hikes that we experienced in 2018.

Returns were strong for the year but comparable to the last few years, as once again it was very important to be invested in the correct markets. The S&P 500 was up 31%, but Mid and Small Cap U.S. stocks were up “only” 24%. Similarly, the Dow Jones Industrials was up 25%, and International stocks trailed even further, up 18% for the year.

The ingredients for a secular bear market still don’t seem to be at hand: the economy continues to bump along at around 2% GDP growth – certainly not strong, but not weak enough to generate a recession. The Fed appears to be on hold, which the equity markets have generally taken solace from. Technical trends are positive, and sentiment isn’t too overbought.

However, there are longer term concerns: the economic expansion is aging; the yield curve is flat/inverted, signaling potential future economic weakness. Europe is still lingering close to a recession; and valuations can only be characterized as somewhat expensive, all while corporate earnings seem to be slowing. While we do not believe a recession is imminent, it’s clear we must keep our eye on the ball!

In summary, the beginning of 2020 looks almost the opposite of how it looked at the beginning of 2019, which makes one wonder should this year also be the opposite of 2019 with poor returns. The current data does not suggest this; in our view the data suggests returns should be positive but below average this year – there isn’t much to suggest that caution is in order, but there also isn’t much to suggest that there is a lot of upside opportunity. It seems more likely than not, that this could be one of those rare years where the market sees ‘average’ returns.

While the equity market averages 8-10% returns over the long term, only 18% of the time it is up between 0-10%. 47% of the time it is up more than 10%, and 35% of the time the market is negative! Supporting the notion of an “average year” is that Dow Jones Market Data figures going back to 1950 indicating that the Dow Jones Industrial Average tends to climb 75% of the time, with an average return of about 8.9% in the year following a previous year with return of 20%. When the market is up more than 30% the average next year return is 15% and only 17% of the time returns were negative.

The Economy and Earnings

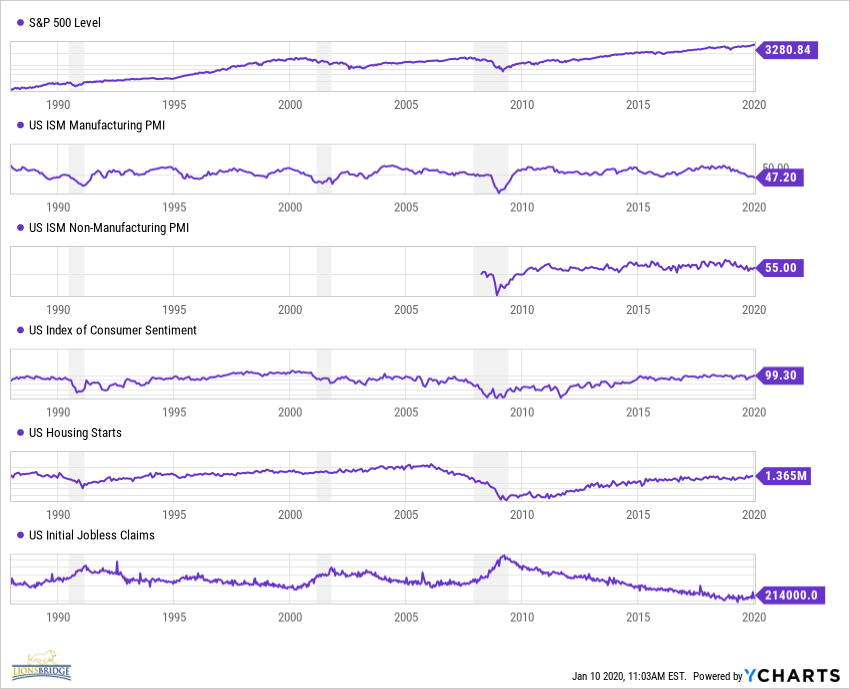

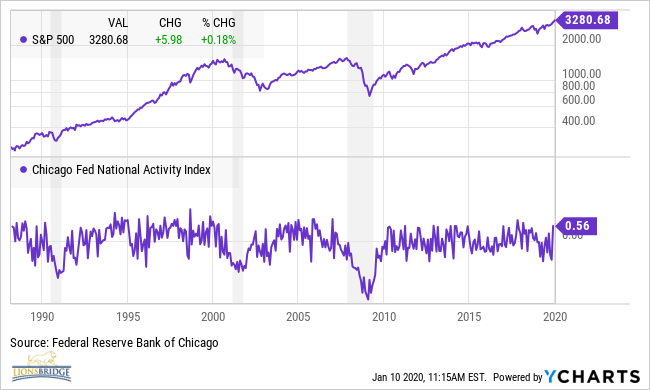

The fundamentals we monitor do not currently suggest a recession is imminent. While the Manufacturing sector is weakening, the Non-Manufacturing sector is still strong and both measures are above 45 (the level where concern over a recession increases). Consumer Sentiment and Housing Starts are strong, and Initial Unemployment Claims are not moving higher (Exhibit A). The Chicago Fed National Activity Index has also stayed above the critical -1% level (Exhibit B). Until these metrics are breached, we will continue to give the economy the benefit of the doubt. Below these levels, recession probabilities increase significantly.

Earnings growth has been flat over the last couple of quarters. While this is not a death knell for the market – we have had many flat periods of earnings growth – but the start of a downtrend in earnings would be concerning. Many CEO’s are expressing concerns that wage inflation pressure is building and crimping profit margins. We will continue to watch earnings reports carefully!

Monetary Policy and Interest Rates

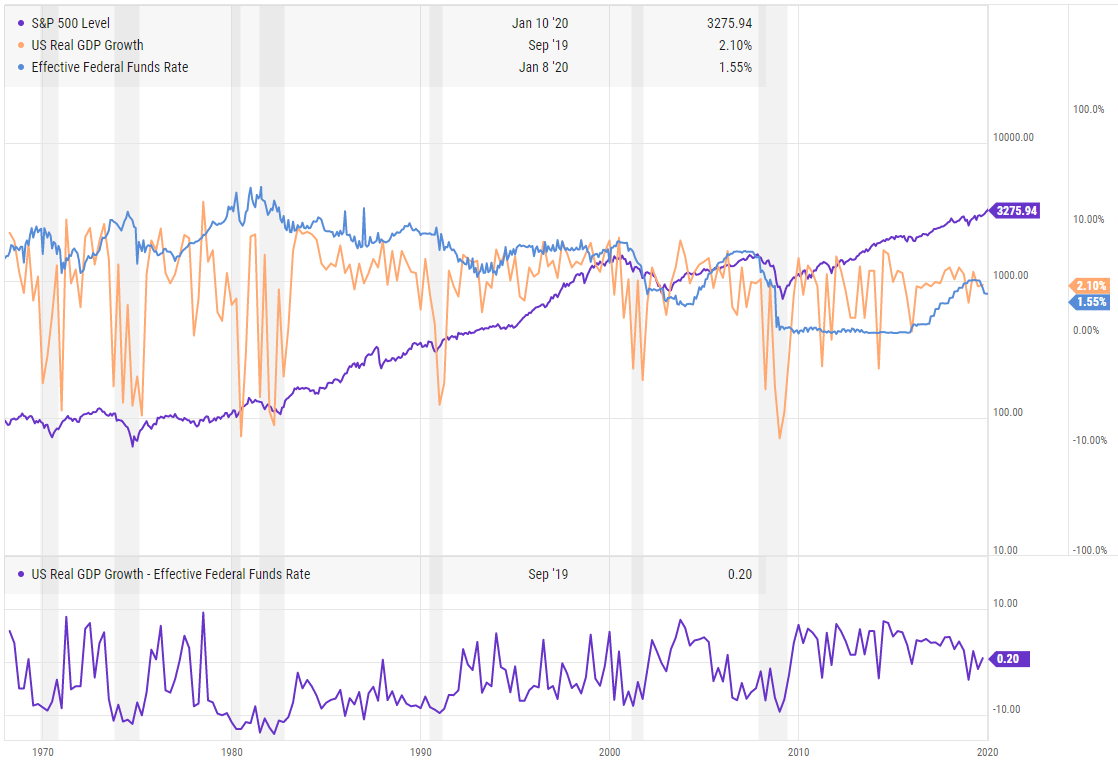

One of the most important catalysts for the market’s rally in 2019 was the Fed’s turnaround in Monetary Policy. Chairman Powell issued a Mea Culpa in January of 2019, signaling that they will no longer be raising rates after the almost -20% swoon in the equity markets late in 2018. The markets were relieved that the Fed was no longer raising rates and quickly rallied in Q1. The Fed followed this by easing in June as concerns over a brimming trade war rose. This action, along with a temporary resolution to the trade war are what ignited the second half rally. Exhibit C demonstrates that if the Fed keeps Fed Funds at or below Real GDP growth, monetary policy is considered accommodative. It’s only when Fed Funds are above GDP growth that policy should be considered restrictive enough to endanger the market. This was the case in 2000 and 2008, and secular bear markets ensued. Currently, Fed Funds are about the same as GDP growth, which is fine. If GDP growth were to weaken and the Fed stayed on hold, we would judge monetary policy as restrictive enough to possibly derail the bull market. Similarly, if the Fed were to raise rates while the economy remains in this “slow growth” mode, we would also be concerned. Clearly, staying on top of the fundamentals in the coming months will be important.

Sentiment and Technicals

With the market at all-time highs, it’s clear that the bulls have the upper hand. Strong momentum and break out’s to new highs are usually very positive for forward returns. Rarely do markets turn on a dime and start heading down after such behavior. Simply said, new highs in the market are not to be feared. However, in the near term, short term sentiment is starting to get quite frothy. The indicators we follow are uniformly suggesting that a pullback of some nature is due. But as we mentioned earlier, if the market were to pullback 5%-10%, it should be viewed as a short-term correction, not the beginning of a larger pullback like we saw at the end of 2018. This of course is predicated on the fact that the Economic Fundamentals and Monetary Policy mentioned earlier do not deteriorate.

It’s clear we have been in a secular bull market now for almost 11 years. It is not uncommon for secular bull markets to run for 15 to 20 years, but that does not mean they are immune to 20% to 30% declines along the way. The 1949-1966 secular bull market had a 30% decline during the steel crisis in 1962. The 1982-2000 secular bull market had the 1987 crash early on, but the bull market went on for another 13 years. The point here is that the potential for a correction is always possible and 4Q 2018 was an example. Generally, these corrections don’t cause an end to secular bull markets unless there is corresponding evidence from the fundamentals or monetary policy.

The longer-term sentiment picture is quite interesting. In November UBS took a poll of more than 3,500 high net worth investors with at least $1 million in investable assets. Fifty-five percent of respondents expect a significant drop in the markets at some point in 2020.These investors have increased their cash holding to 25% of their average assets. Natixis surveyed the world’s large investment funds, such as pension plans, endowments and insurance firms, and almost half think the stock market is due for a correction in 2020. Pervasive long-term pessimism is not usually the way tops in the market are formed. Historically, there is much more swagger and optimism from investors as they throw caution to the wind.

At the end of 2009, most investors—individuals and professionals alike—expected interest rates to rise, inflation to return, the dollar to weaken, commodities to boom and U.S. stocks to struggle. Bill Gross was actively promoting his scenario of “the new normal,” which he described as “likely to be a significantly lower-returning world” for stocks and bonds alike for years to come. (Mr. Gross left Pimco in 2014 and retired from money management earlier this year)

Instead, over the ensuing 10 years, interest rates fell to historic lows, inflation all but vanished, the dollar strengthened, commodities languished, and U.S. stocks earned among the highest returns they have produced in any decade. Even more surprising, bonds did well, growth stocks beat value, large stocks beat small and shares from the rest of the world lagged far behind the U.S.

The point here is that investors tend to base their expectations of the future based on the experiences of the recent past, but the future often is very different. Knowing what the masses expect and taking a contrarian view is often the correct view.

US Elections and Geopolitics

We have opined many times over the years that politics and election results generally are not a major influencer of markets. However, it has been proven that politics do matter if one party or another controls all 3 major branches: House, Senate and the White House. While this does not appear to be a major concern looking ahead to this election, there is a change underfoot as the Democrats appear to be leaning much further left than they have in a long while. Senator Warren and Senator Sanders are near the top of the pack and it is hard to believe that the market will not react negatively if they come out as the Democratic front runners after Iowa and New Hampshire. Our guess is that a more moderate voice or pro-business candidate like Mr. Biden, Mr. Bloomberg or President Trump carry the day with a divided congress and the markets will move on from politics and focus on the fundamentals.

Geopolitics have factored into market volatility as of late (Iran & Trade War) We cannot dismiss the risk that these situations may escalate further into a broader conflict. However, from a market perspective, we want to be careful not to overstate the potential impact.

History shows that stocks have largely shrugged off past geopolitical conflicts. LPL Financial looked at significant geopolitical events dating back to 1990 and found that the Dow Jones Industrials Average has fallen an average of only 2% during 16 major geopolitical events, including the Gulf War, Iraq War, and 9/11. Over the subsequent 3 and 6 months, the Dow rose 88% of the time, with average gains of 5% and 7.9%, respectively. Similarly, a review of 20 major geopolitical events dating all the way back to World War II showed stocks had fully recovered losses within an average of 47 trading days after an average maximum drawdown of 5%, according to a CFRA study.

The takeaway here is that while Geopolitics touch a sensitive nerve in all of us, as investors, the reality is they have much less of a long-term effect on the markets than we realize.

Equity and Fixed Income Strategy

For the year, our equity strategy was able to finish ahead of its Policy Benchmark. Our stocks did well this year, performing about the same as the S&P 500 and well ahead of the Dow Jones Industrial average and most other value-oriented indices. This is no small feat as our approach does have a value and quality bias, yet we were able to do much better than other managers following the same bias, in a market dominated by mega cap growth.

We were also correct in underweighting US Mid and Small Cap as well as International markets. We doubt we will change this much unless the outlook for global growth improves, and/or we enter a bear market as both scenarios would favor these areas as opposed to US Large Cap. Underperformance by international stocks has been a persistent theme in this bull market as this sector has underperformed the S&P 500 in 8 of the last 10 years. International stocks have returned 72% in the MSCI EAFE Index while the S&P 500 has returned 274% over the same period. Non-U.S. developed markets equities continue to face several structural headwinds, including aging populations, greater regulation, less flexible labor forces, and high debt levels that make additional fiscal stimulus politically less palatable. Despite that, we haven’t given up on International even though tactically we are currently underweight. There will be periods of strategic value of some geographic diversification over the long run, but we will need a more favorable environment to foment this.

Our alternative sleeve, since the high of last year (including both a mini-bear and min-bull market) was also able to exceed our peers while providing positive performance in a very difficult market in 4Q 2018, which is exactly what we are looking for from this portion of the portfolio.

Interest rates are stubbornly low and we continue to feel that rates should drift higher in a stable economic environment. If the economy were to weaken, we will be quick to extend durations and attempt to pick up some price appreciation if rates were to decline.

Exhibit A

Exhibit B

Exhibit C

Leave A Comment