Why did the market go down so much, and why has it rallied so much?

The market started the year with upside momentum and the hope that a US China trade deal would help kick start the global economy. The market was up about 10% by February, but the outbreak of Covid-19 quickly derailed the upside momentum and changed the way we look at our world, probably a few times in different directions. From the Feb 19 high, the market plunged -34% in 23 trading days. Since then, the market has rallied 36% in 45 trading days. For those of you that understand the math of percentage changes, that does not mean we are back to break even, and now the market is down about -10% from the highs. Such volatility made little sense to investors on the way down, and now on the way up it makes even less sense.

The best reason we can assign to this unprecedented volatility is that market do not move on what we already know, or which is already “baked into the cake”. The market does a very good job of discounting what the current economic numbers are, and then projects what it expects to occur over the next 6-12 months. Usually this is a slow process, like maneuvering an oil tanker, it takes a lot of momentum to get it to move one way or another and when it does move, it is slow, but a global pandemic will change that. Covid-19 turned the economy from an oil tanker to a speedboat, and the market acted as it always does, discounting what has occurred and is looking forward 6-12 months. The market has gone from expecting – and getting – a depression, resulting from shutting down the global economy in an effort to stop the spread of the SARS-CoV-2, to a budding recovery as the economy is starting to open back up. Combine the positive news that social distancing has had on Covid-19 with unprecedented fiscal and monetary stimulus and you have the ingredients for retracing 2/3rd of the decline.

Outlook

On the way down, our response was based on the trends that our models follow – short, intermediate, and long. The unprecedented collapse turned all our models negative, and our Alternative Strategy did a great job of mitigating downside volatility. Our returns in the decline where much better than the market. As things turned around, our models re-engaged, and we are presently close to being fully invested. The net result is the equity portion of our accounts are down about half of the market, and we enjoyed a much smoother ride.

Going forward, there are many paths the market could choose based on the fundamentals. Will the spread of the virus continue to improve? Will we get a vaccine or treatment? Will we have a second wave in the fall? If things continue to improve, will the fiscal and monetary stimulus be removed? How will the election go? Obviously, there are a lot of paths the market could choose, and the future is very uncertain. As always, rather than guessing, we will be relying on our trend models to keep us in step with the market.

Currently, our short-term sentiment models are showing the market may be a little toppy, but our longer- term sentiment models are at a neutral reading. Our read on this is that near-term returns might be a little choppy, but longer term there is still room for the market to move higher. How much higher is very much dependent on the fundamentals, which are especially uncertain!

A longer-term comment on the markets

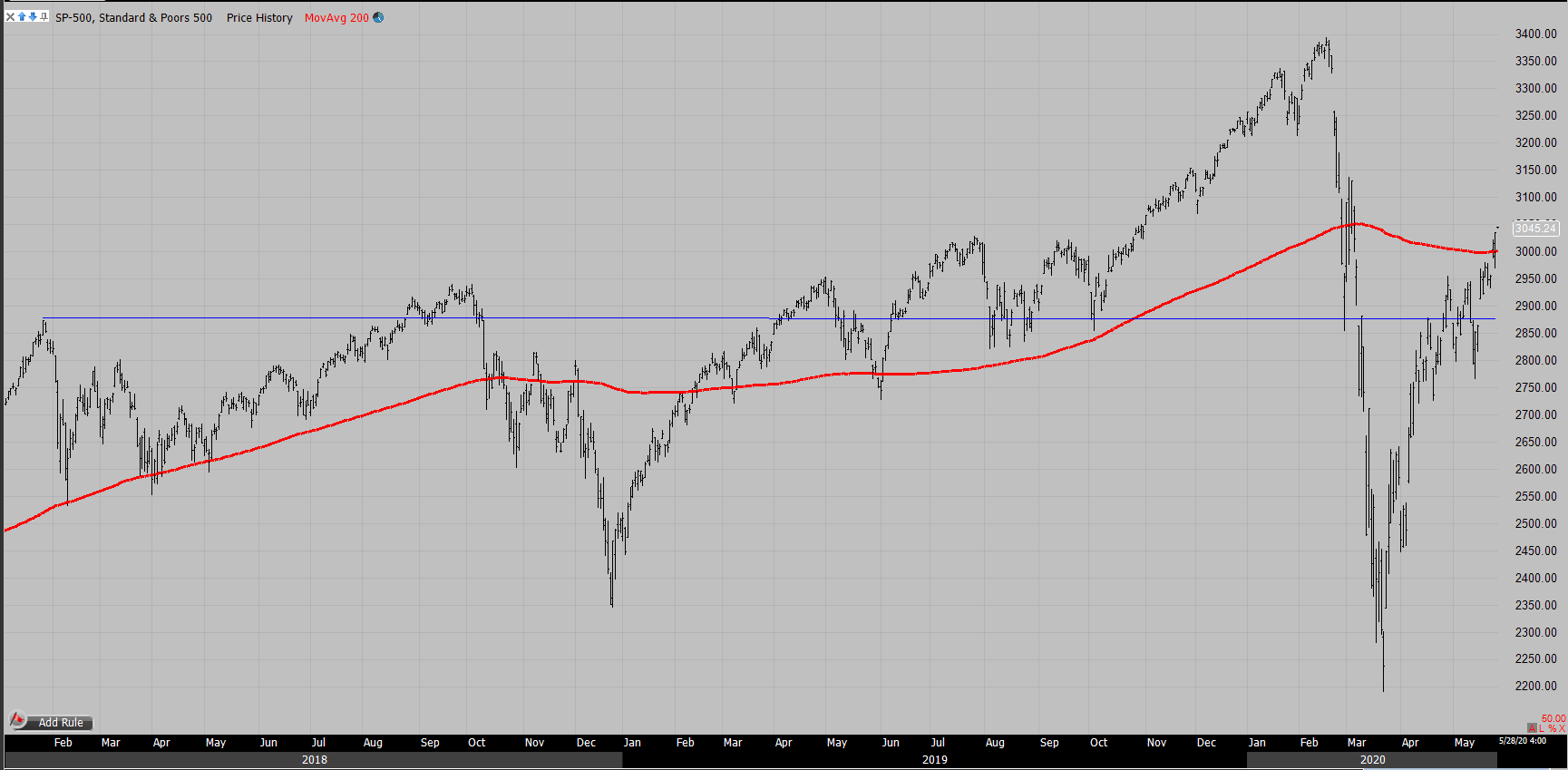

On an intermediate term basis, you can see that the market traded below the 200-day moving average (red line) in February of this year, and yesterday we closed back above it. This line is a good general gauge of the market trend. Our models are much more specialized and accurate than this, but this is a good general measure to evaluate. The 200 MA has generally been rising during this time frame, which has also been the case since 2012. Getting back above the 200 MA is a positive indication, and it is now rising again, so together this is positive. However, for almost 2 ½ years now the market has been locked into a range – the horizontal blue line is where the market was in early 2018 and while we have been both above and below this line over the last 2 ½ years, we have made little progress.

Longer term, we believe the reason that the market has stalled over the last 2 ½ years is that earnings growth has been modest at best. The economy was in great shape coming out of the Great Recession of 2008 and once the dust from that had cleared, from 2012 to 2017 the economy was strong. However, since that time, the economy has slowed. Not enough to create major issues, but enough to stall out the market. These results stemmed from anemic global economic growth with the US being the best house on a bad block. The tonic that has soothed over this low growth economy has been fueled by a low interest rate monetary policy. Since the Great Recession, the Fed has engaged in an exercise called “expanding its balance sheet”, whereby the Fed has been utilizing monetary policy to keep interest rates exceptionally low. We have seen an unprecedented expansion of this power this year, as the Fed has expanded their balance sheet by $7 Trillion, almost 1/3 of the economy! The result is the Fed Funds are back to 0% (Like 2008) but the rest of the yield curve is much lower. 2 Year Treasuries are at 0.2%, and 10-Year Treasuries are at 0.7%. Clearly, we are reaching the lower bounds of where interest rates can go. While negative interest rates are certainly possible, we must assume that the bulk of interest rate declines are behind us.

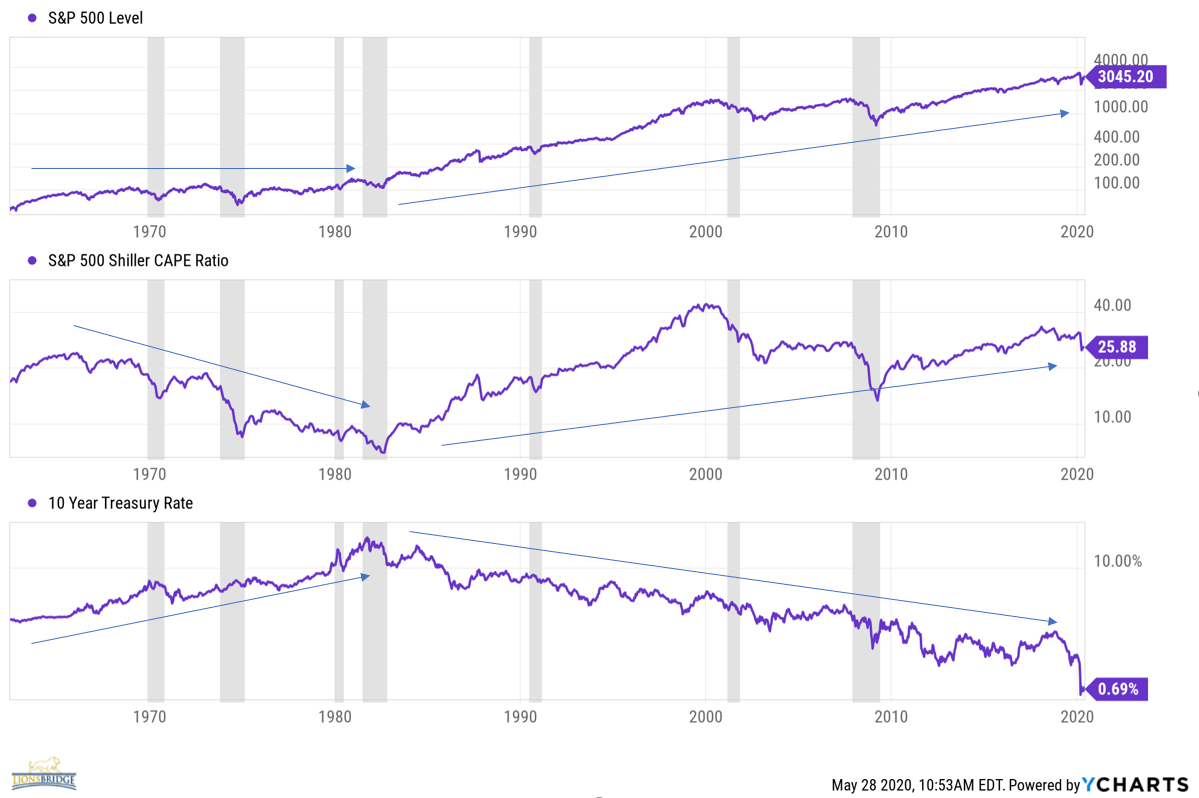

We believe this has important ramifications for the next 5-10 years, maybe longer. Our reasoning lies in the chart on the next page. This chart shows the S&P500 in the top panel, P/E Ratios in the middle panel, and Interest Rates in the lower panel. This chart goes back to 1962. From 1962 to 1981 you can see that interest rates rose steadily to the peak in rates in 1981. When interest rates rise, the law of discounting cash flows dictates that asset prices are less attractive. Valuations go down in such an environment and P/E Ratios went from 23 to 6 and the market traded sideways for 20 years. Since then rates have been declining which, of course, has had a positive effect on valuations, as P/E ratios rose from 6 to 25 recently.

While we are not predicting an immediate rise in rates, it seems safe to assume that it will be very difficult for rates to continue declining. If this is the case, it seems likely that valuations – no matter how you calculate them – are currently at levels that will be a head wind for the market, and at worst could usher in another period like 1962 to 1981.

This view does not mean that we are necessarily bearish on the markets in the short to intermediate term. We see many possibilities in the near term for the market to do quite well if things continue to improve. Looking out into the coming decade, bull markets may be shorter in duration and extent, and the number of bear markets may be higher, and their duration and/or extent may be larger than we have had. We have enjoyed market returns far in excess of the historical norms since 2009, and our outlook is for potentially lower market returns which are more volatile than we have had over the past 10 years.

Buy-and-Hold-Investors have been rewarded handily for owning both stocks and bonds for quite some time, and we believe returns will not be as attractive as they have been. That does not rule out bull markets at all but suggests choppier markets conditions that are peppered with both bull and bear markets. Over the last 10 years, Bear markets have been rare and short-term affairs. We believe their frequency and extent will increase in the coming years as the wonderful back drop of lower rates for almost 40 years comes to an end.

What does that mean in the coming years if this outlook is correct? In our view, it suggests that traditional asset allocations, a static mixture of stock and bonds, are likely to underperform historical norms. In this type of market environment market, we believe the Alternative asset class will be a much more important contribution to returns to investors than returns that come from “beta” or just owning the market.

To navigate this type of market cycle, it will likely require an expansion of long/short approaches in the Alternative asset class. We have already done this with success this year. Additionally, we are considering adding exposure to approaches such as market neutral, low beta, call writing, Gold and Managed Futures. In a nutshell, equity strategies which can hedge and take advantage of both good and bad market environments, or strategies that are uncorrelated to the broader markets. We are also seeking out non-traditional approaches in the fixed income arena. Having a broader mandate to hedge against rising interest rates or seek out ways to improve income in a very low return fixed income world will be key.

Leave A Comment