Given the latest pullback in the market, we wanted to remind investors the importance of staying the course. The S&P 500 has declined about 11% from its closing high earlier this year. Is this abnormal? Should you be concerned? Should you do something different?

Capital Research & Management Co. analyzed the U.S. stock market for declines from 1900 all the way to 2014. They found that:

- Declines of 5% happened on a frequency of approximately three times a year.

- Corrections, declines of 10% or more, occurred about once a year.

- Declines of 15% happened every two years.

- Bear market declines of 20% happened every 3.5 years.

The asset allocation we use for you was based on your unique risk tolerance that we hope can be held through good times and bad. Our job is to try to be as conservative as possible in the declines and do better than the market during these pullbacks. Together, this should result in above market returns over the long term while muting the volatility.

- Exhibit 1 shows a chart taking a different approach. Here we have a hypothetical investor who decides to go to cash when the market declines 5%, and then gets back in when things look better after a 3% rally. As you can see, there are very few times where this approach would outperform sticking to a plan.

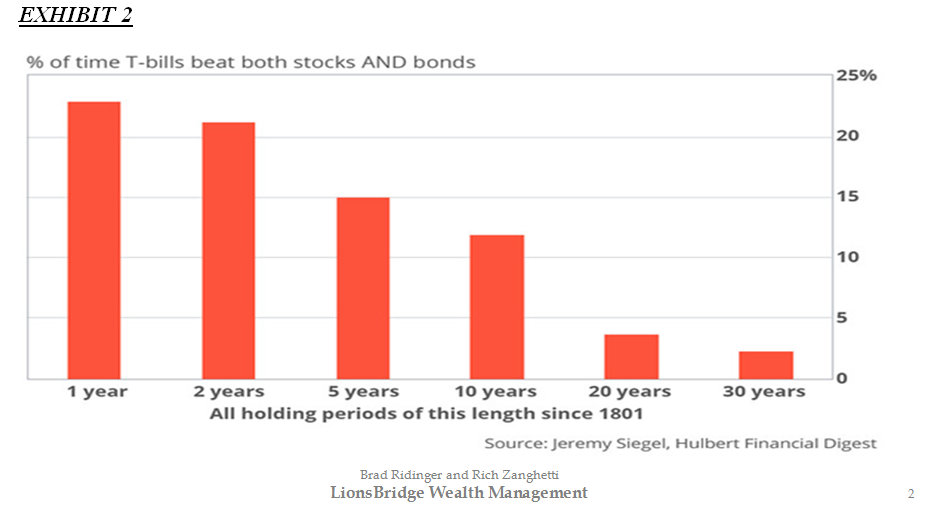

Looking at this a different way, Exhibit 2 shows how often cash has outperformed stocks and bonds. Over a normal market cycle of 5 years, cash has outperformed stocks and bonds only 15% of the time. If you go out over longer holding periods, cash does even worse. Even over a short time frame such as 1 year, cash only outperforms 22% of the time.

Our conclusion is simple: In trying times, the pull to reduce equity allocation and / or go to cash can be very strong; however, these pullbacks are a normal, expected but unenviable occurrence as an investor. While most everyone points to 2008 and says, “I should have sold back then”, the truth is that years like 2008 are exceptionally rare. Adjusting your strategic asset allocation, while the market is in the midst of a correction, often has a greater chance of hurting than helping your returns.

Our Tactical strategy is designed to help buffer the downside when the market declines. We have spent a great deal of time researching the best allocation to this Strategy, and for most clients, we have found that having 40% of your equity exposure in Tactical gives us the best mix of after tax return with risk reduction. If you feel you need more protection, we can use an approach that either has more in bonds or more of the equity exposure in Tactical. Like everything in investments, there are tradeoffs to these decisions. Your long term returns, especially after taxes will likely be less, but you will likely have more downside protection.

Please contact us if you feel your needs have changed so we can work through an allocation that is best for you.